You may have a lot of questions, but you only need to understand 5 concepts to answer these questions. If you understand these 5 concepts, then you will understand the whole game of cryptocurrencies. To understand these 5 concepts, you do not need to read another article.

1. Money vs. Currency

In this article, you will understand all 5 concepts. So let’s start with the very first concept. Now you see here, money vs. currency. Till now, the currency in your pocket, you were considering it as money. The ₹ 2000 note as an example, you were considering it as money. But let’s assume that if the government announces today that after today, the ₹ 2000 note will not work, then the value of the money in your pocket will be zero. But there is a difference in money. Its value cannot be zero.

Why not? Because money has its own value stored. For example, you have a gold coin and there is a value of that gold coin. You can exchange it through currency, but you know that there is a value in it. The government cannot ban it and it will work all over the world. Currency may not be acceptable in any country. You have to convert it to USD first, then you have to take it. There are a lot of problems, but something like gold or something like silver or those who have value, it works everywhere and that’s why you will have to understand that.

There is a difference between currency and money because currency can be manipulated. The government regulates it, but it also manipulates it. Now I will tell you how and why, but the currency can be printed as much as you want and the money can be printed as much as you want. No gold coin can be printed sitting at home. You can’t even print currency sitting at home, but what I mean to say is that the government can print the currency as much as it wants, but where will the gold coins come from, it will have to do mining for it.

2. Centralized vs. Decentralized Systems

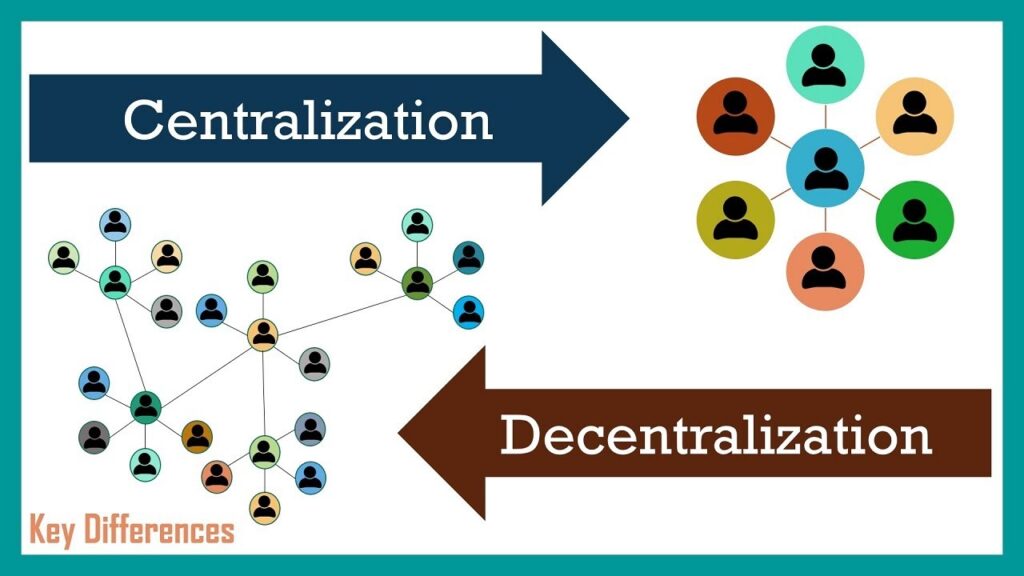

Now we move towards the second concept and that is centralized versus decentralized. Currency can be centralized or decentralized. Understand this, I will explain it to you now. The money you use, our government controls it. It can print as much as it wants and from which inflation comes. The biggest reason for inflation is that the government can print as many notes as it wants.

It is centralized by the government, but decentralized means that the government does not control it. Example Bitcoin, no government is controlling Bitcoin and Bitcoin cannot be printed as much as it wants. It has a limited resource, limited supply, so because it has a limited supply, there is a value stored in it. Now because the value is stored and it is limited, people say it just acts as a gold. Gold is also limited and Bitcoin is also limited. So in the coming time, people say that the money of Bitcoin will increase.

Now because no government is manipulating it, there are no regulations in it. So what is the difference here? I will tell you a very big difference. Just Google about China. China once dropped its own currency. If it dropped its own currency, then you would think that it would have had a big effect on their country, but the currencies are very interconnected. So they dropped their own currency and it had an effect on the US. It had an effect on the US stock market. So now if the government manipulates its currency, then the whole world is in danger of it.

That is why it is said that necessity is the mother of invention. The birth of decentralized currency is what we call cryptocurrency. Now you will say that there are many small currencies in cryptocurrencies that people can regulate. For example, Dogecoin. Now if it is a small coin, now Dogecoin is also not small, but if a big player comes, if a big bull comes, then what can it do inside it? What did ElonMusk do? Whenever he increased it, whenever he dropped it, because the size of the market is still very small.

When the size of the market will increase, for example, today the size of the stock market is very big in front of the cryptocurrency market. So if someone comes and puts 1000 crores or 10,000 crores, then he cannot manipulate the whole market. Yes, a stock can also be manipulated here. So if you want a article on stock versus crypto, then do comment below. We will surely try to write an article on stocks versus crypto. So what are the similarities and differences, we will tell you, but you must be understanding here. You must have understood the second concept that what is the difference between centralized and decentralized.

3. Fiat Currency

Now the third concept is fiat currency. Now what does fiat mean? Now people say that fiat means fake and the money we are using, the dollar we are using, the euro we are using, the yen we are using, all this comes under fiat currency. Why does it come? A few years ago, you or any country could print as much currency as it has gold in its reserve or assets.

Now in today’s date, the countries that are printing notes, there are no assets behind it. They are not backed by any asset. Print as much as you want. So you already know what happened with Zimbabwe and there are many such countries that have drowned their own country’s economy while printing notes. So because it is in the hands of fiat currency, people think it is a fake currency. It is not backed by any gold. It is not backed by any assets. So this is my suggestion. It is not just about cryptocurrencies. It is about the money you get, you convert it into assets.

whether it is in gold, whether it is in silver, or if you get more money, you take a loan. But what will be the benefit of this? That the value of your money will not depreciate. You will also be safe from inflation and God forbid, as it happened with other countries. But yes, a lot of notes are being printed. After Corona, how many notes have been printed by the government, you will tell by commenting below.

4. Digital vs. Physical Currency

Now let’s understand the fourth concept here and that is digital versus physical currency. Now digital versus physical. A few years ago, people did not trust paytm. People thought that they were putting money in it. What if Paytm runs away? Because it is digital. People thought that digital can only be in the bank. That too in our statement. If we see it in the account, then we will believe that the money is in our account. Otherwise, people believe only in physical currency.

But that 50,000 can be snatched, lost, a rat can enter, it can be stolen, anything can happen. But digitally now people think it is safe. Earlier people did not think. Earlier people did not trust digital. But cryptocurrencies are totally based on digital, digital technology. It is totally digital. It will not come in your hands. You must have seen the Bitcoin coin many times, but you will never get it in your hands. It is a digital form of currency. So why do you need a digital form of currency?

You are understanding. Now if you want to invest in cryptocurrencies, then you can go to CoinDCX and you can easily invest and trade in cryptocurrencies.

5. Blockchain

Now finally we will talk about the fifth concept on which cryptocurrencies are based and that is Blockchain technology. Well, a lot of people say that we do not trust cryptocurrencies so much, but we have a lot of faith in Blockchain technology and this is the same statement from the RBI Governor. He said that the technology behind cryptocurrencies is something that we should adopt and that is Blockchain technology. Now what is this technology? It is a simple thing, which we call Ledger. Ledger means maintaining an account. We maintain any transaction.

Now whatever your transaction is, your bank is maintaining it. So all the records are with the bank, but you have seen the movie of Harshad Mehta. You found out that if inside the ledger, you saw the case of SBI, if the entry is removed from the ledger, then how much will have to do for it, how much investigation will have to be done. Later it will be found out that if there is any fraud and inside the banks, you have seen that many banks have with it. Blockchain technology says that you cannot delete any entry.

Here people have their own computers. Now there are miners here, there are mining machines, we have already talked about it, but still I am telling you. Now whenever there is a transaction here, that transaction is being verified by going to every stage here. And if there is any error in the middle, then there will be no verification. So because your ledger is maintained in many steps. So what is the benefit of blockchain technology? No one can manipulate the ledger. No one can manipulate the figures.

Every transaction is being recorded and a lot of research is going on. Now this is a comparatively very new technology and that is why the entire market of cryptocurrency, it is an emerging market, it is a new market. So now predictability in this, means a lot of people can say that it can increase, anything can happen. This is a highly volatile market. Because the size of the market is also very small, there are some players who increase and decrease the price a lot.

So a lot is going on here and people have generally seen that whenever a new technology comes, it happens inside it. You have heard the name of dotcom mobile. When the internet came, what happened? And today everyone is using the internet. So when there is no technology, its users are also limited and it takes time to gain trust. But as the things go well, as things go ahead, in the future, what do you think? What is the future of cryptocurrencies according to you? Do tell us by commenting below.

Finally, If you like the article, then let me know in comment box . Do share it so that all the people who want to understand these five concepts, which you have understood today, they can also understand it. I will see you in the next article. Till the time, you go self-made.

Disclaimer

I AM NOT A LICENSED PROFESSIONAL NOR INVESTMENT ADVISOR. All of my content, including but not limited to, my cryptocurrency articles, streams, investments, stocks, strategies are for entertainment purposes only, reflect only my personal views, ideas, and opinions, and should not be construed as personal investment advice. While the information is believed to be accurate, it may include errors, inaccuracies, or omissions. No representations or warranties are made in connection there with and you should never take any of this information as guidance for buying or selling any type of investment. Nothing here in or there in shall be construed to be financial, legal, or tax advice. Purchasing cryptocurrencies, NFTs, or stocks can be highly speculative and pose considerable risk of loss of your entire investment. You should always conduct your own due diligence and seek the advice and/or counsel of qualified and licensed professionals and advisors. I will not and cannot be held liable for any actions you take as a result of viewing and/or reading any of my content and/or any losses in connection therewith. There are some affiliate links in this description, which I may earn commissions from. Beware of impersonators. Please do not send me money, ever.